How to Get Pitch Decks Approved by Investors

“`html

Understanding the Basics of an Effective Pitch Deck

An effective pitch deck serves as the cornerstone for any successful funding round, providing potential investors with a comprehensive overview of your business. A well-structured pitch deck typically contains several key components, each tailored to convey crucial information succinctly and compellingly.

The first component is the problem statement. Clearly articulating the issue your business aims to solve sets the stage for why your enterprise exists. This section should be grounded in factual data and ideally, include real-world case studies or testimonials. Connecting the problem to the audience’s pain points can make your pitch more relatable and compelling.

Following the problem statement is the solution. This is your opportunity to showcase what makes your product or service unique and how it effectively addresses the problem at hand. Explain your unique selling proposition (USP) and highlight any innovative features that differentiate you from competitors.

The market opportunity section addresses the size and scope of the market you’re entering. Investors seek assurance that there is a significant market demand for your solution. This part of the pitch deck should include market research data, industry trends, and an analysis of your target audience. Quantifying the total addressable market (TAM) can be a persuasive way to demonstrate growth potential.

Your business model outlines how your company plans to generate revenue. Detail your pricing strategy, sales channels, and customer acquisition plan. This section should demonstrate a clear, realistic pathway to profitability.

Showcasing your traction, or the progress your business has made so far, is imperative. Metrics such as customer growth, revenue milestones, partnerships, or product development stages act as tangible proof of your venture’s viability and momentum.

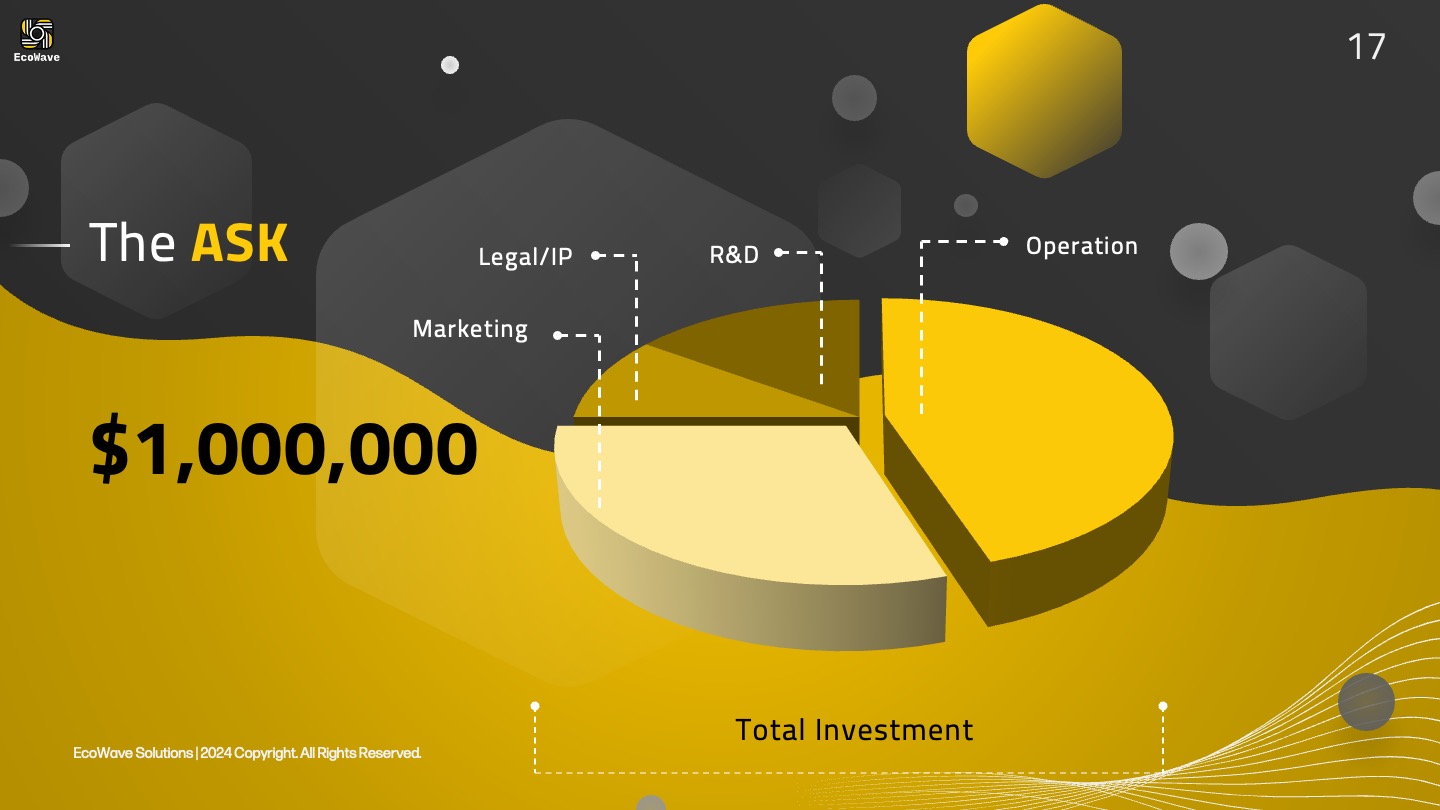

The financial projections provide a forecast of your company’s economic future. Include projected income statements, balance sheets, and cash flow statements for the next three to five years. Transparency and realism in your financial projections can build trust with investors.

Lastly, the team introduction underscores the expertise and experience of your leadership team. Highlight each member’s credentials, industry connections, and previous successes to instill confidence in your team’s capability to execute the business plan.

In addition to these components, effective pitch decks weave a compelling narrative that resonates emotionally with investors. Incorporating storytelling techniques can help present data and ideas in a more engaging manner, making your overall pitch more memorable.

Researching and Targeting the Right Investors

One of the most crucial steps in getting your pitch deck approved by investors is identifying and understanding the right audience. Researching potential investors thoroughly provides invaluable insights into their preferences, industry focus, and past investments. By doing so, you can tailor your pitch to align closely with their investment philosophy and increase your chances of success.

Start by compiling a list of potential investors who are known to invest in your specific industry or sector. Platforms like Crunchbase, LinkedIn, and AngelList are excellent resources for finding detailed profiles of venture capitalists and angel investors. Look for patterns in their investment choices, such as the stages of funding they prefer (seed, Series A, etc.), the typical size of their investments, and the geographical regions they focus on.

Understanding an investor’s portfolio can also provide valuable insights. Review the companies they have backed previously and analyze what made those ventures appealing. This can guide you in highlighting the aspects of your business that are most likely to resonate with them. Additionally, reading interviews, articles, and blogs written by the investors can offer a candid view of their criteria for investment.

Networking is another key element of targeting the right investors. Attend industry conferences, seminars, and networking events where you can interact with potential investors. Join relevant online communities and forums to engage in conversations and build relationships. Leveraging connections can also prove advantageous. If you have mutual contacts with an investor, request an introduction. Personal connections often lead to a more favorable reception and can offer an opportunity to present your pitch in a more informal, yet impactful setting.

When conducting personalized outreach, crafting a concise and compelling message is essential. Personalize your communication by referencing any previous encounters, common interests, or mutual connections. This shows that you have done your homework and are genuinely interested in forming a partnership.

Finally, tailor your pitch deck to suit the specific interests and requirements of each investor. One size does not fit all when it comes to pitching. Customize your content to emphasize the aspects of your business that align with their investment strategy. Address any potential concerns they might have, and be prepared to answer sector-specific questions. This personalized approach not only showcases your diligence but also demonstrates your adaptability and commitment to meeting their expectations.

Presenting Your Pitch Deck: Strategies and Best Practices

Successfully presenting a pitch deck to investors requires more than just having a great idea; it’s about delivering your message with clarity, confidence, and enthusiasm. A persuasive narrative is the cornerstone of a compelling pitch. Start by succinctly outlining the problem your product or service addresses, followed by your innovative solution. Use storytelling techniques to make your presentation more relatable and memorable. This not only captures interest but also demonstrates the real-world value of your proposition.

Engaging presentation techniques can significantly contribute to the effectiveness of your pitch. Maintain eye contact with your audience to build a connection and convey sincerity. Your body language should exude confidence without crossing into arrogance. Utilize vocal variety to emphasize key points, making your pitch dynamic and engaging. Remember, it’s not just what you say, but how you say it that can make a lasting impression on investors.

Visual aids are a vital component of an impactful pitch. They should reinforce, not overwhelm, your narrative. Use slides to illustrate critical data points, highlight competitive advantages, and map out your market growth potential. Ensure your visuals are clean, professional, and devoid of excessive text. Think of them as your support team, working behind the scenes to bolster your message.

Avoid common mistakes that can detract from your pitch. Overloading slides with information, failing to anticipate questions, and not rehearsing adequately are pitfalls that can undermine your efforts. Practice your pitch multiple times to gain fluidity and confidence. Run through potential questions investors might pose, and have succinct, well-thought-out answers ready. This preparation demonstrates your thorough understanding of your business and the market.

Exuding passion, vision, and expertise is paramount. Your enthusiasm is contagious and can convince investors of your commitment to your venture. Clearly convey your long-term vision and how you plan to achieve it. Showcase your expertise by explaining industry trends, competitive landscapes, and your strategic approach. This convinces investors that you and your team are not only passionate but also competent and prepared to execute your business plan.

Following Up and Refining Your Pitch Deck

After presenting your pitch deck to investors, the next crucial step is to follow up effectively. A prompt and professional follow-up not only demonstrates your commitment but also keeps the momentum going. Send a thank-you note within 24 to 48 hours after the meeting. This note should express gratitude for their time, reiterate your enthusiasm for the opportunity, and offer to provide additional information as needed.

Responding to investor feedback is an essential part of refining your pitch deck. Investors often provide valuable insights and constructive criticism that can help you improve your presentation. Review their feedback carefully and make necessary adjustments. This iterative process is vital for honing your pitch deck to better meet investor expectations and address any concerns they may have.

Maintaining an ongoing conversation with potential investors is key. Keep them informed about significant milestones, achievements, or any changes in your business strategy. Regular updates show that you are progressing and are serious about growing your business. This continuous engagement can help build trust and keep investors interested over time.

Refinement should not stop at just improving the pitch deck. Also, consider tweaking your overall proposition based on feedback. This might involve revisiting your business model, financial projections, or market strategy. Demonstrating adaptability and a willingness to evolve based on investor input can significantly enhance your credibility.

When it comes to timing and approach for subsequent funding rounds, it’s crucial to be strategic. If initial investors remain interested, update them about your readiness for the next funding phase. Clearly outline your progress and future plans to justify the need for additional investment. A well-timed follow-up can reignite interest and encourage commitment from investors who may have been hesitant initially.

Ultimately, successful follow-up and continuous refinement of your pitch deck require a balanced combination of persistence, adaptability, and clear communication. By effectively responding to feedback and maintaining strong relationships with investors, you can significantly increase your chances of securing the necessary funding to propel your business forward.