Investor Secrets: 10 Common Pitch Deck Errors and How to Fix Them

- A Pitch Deck Without a Story is a Movie Without a Hero

A pitch deck needs more than just slides with statistics and financials; it needs a compelling story. Investors want to know why you are passionate about solving the problem your startup addresses. Without a personal, engaging story, your pitch deck will feel disconnected. Think of the story as the emotional hook that sets up the problem your business is solving. A well-crafted story allows investors to relate to the problem and understand your personal motivation behind launching the business. The story is not just about your business; it’s about why you’re standing in front of them, asking for their investment.

For example, a client of mine had a ticketing app in Africa, and his story began with a personal experience of buying fake concert tickets when he was about to propose to his girlfriend. This emotional experience led to a revelation: 40% of concert tickets in Africa were fake. From this personal story, we transitioned to the problem slide, making the pitch more memorable. Investors need to connect with you emotionally before they believe in your solution. Make sure your story creates an emotional touchpoint.

- A Startup Without a Traction Slide is Like a Ship Without a Compass

Traction is one of the first things investors look for, but what if your startup is early-stage and has no traction yet? Most entrepreneurs worry they won’t secure funding without any traction, but that isn’t necessarily true. There are ways to demonstrate momentum, even without a product or paying customers. If you are a B2C startup, create a website showcasing your product design and include a clear call-to-action (CTA) that collects emails from interested users. Even if you don’t have a live product, a list of potential customers shows investors there is a demand for your solution.

For B2B startups, reach out to companies that might buy your product, offering them a discounted rate or free trial in exchange for a letter of intent. This serves as early validation that your solution is needed in the market. Traction doesn’t have to mean revenue; it means showing you’ve taken steps to prove your business concept works and has interested parties. Show investors that people are engaging with your idea, whether through a mailing list, user engagement, or pre-sale commitments.

- Stop Making False Promises

A common mistake founders make is overpromising on their product or service. Investors are experienced and knowledgeable in their fields, so when you claim to be the “fastest,” “best,” or “most innovative” without concrete evidence, you risk losing credibility. Investors will ask for proof, and if you don’t have it, your entire pitch falls apart. Instead, be realistic. Show that you’ve done market research, know your competitors, and explain what you’re doing differently. Investors don’t need exaggerated promises; they want to know how your startup will solve problems in a practical, scalable way.

If you can’t back up your claims with data, avoid making them. A more effective approach is to focus on real results you’ve achieved or will achieve. Demonstrating an understanding of the market and its challenges can be more compelling than making grandiose statements with no proof.

- Don’t Let AI Write Your Pitch Speech

While AI can be helpful in many ways, it should not be used to generate your entire pitch speech. AI lacks the emotional intelligence and nuance necessary to connect with investors on a personal level. Investors want to hear your voice, your passion, and your understanding of the problem and solution. A pitch speech written entirely by AI often feels generic and lacks the authenticity investors crave. Use AI for proofreading and grammar, but write your speech yourself, making sure it’s infused with your personality and vision.

When presenting, remember that investors are not just evaluating your business; they are evaluating you as a founder. You need to convey why you’re the right person to bring this solution to market. Your speech should showcase your experience, insights, and ability to execute on your vision. Investors are not looking for robotic perfection; they are looking for authenticity.

- Never Present Yourself as a Solo Founder Without a Team

Investors are hesitant to back solo founders because building a business is rarely a one-person job. While you can be the visionary behind the idea, you need a capable team to help execute it. If you’re a solo founder, make sure you present your key team members or advisors. Even if they’re not co-founders, having the right people in place, whether they handle marketing, development, or operations, shows investors you’re serious about scaling the business.

If you don’t yet have a team, highlight how you plan to build one and the roles you need to fill to succeed. Explain the skills you bring to the table and how the addition of new team members will help complement those skills. Investors need to see that you can delegate and manage a team to bring your vision to life.

- Stop Changing Your Pitch Deck After Every Single Feedback

It’s easy to fall into the trap of continuously tweaking your pitch deck based on feedback from every investor you meet. But this approach can backfire. Every investor will have their own opinion, and trying to cater to everyone will dilute your message and confuse your vision. Instead of constantly changing your pitch, stand firm on what you know works. Of course, constructive feedback is valuable, but use it to refine your approach, not overhaul your entire strategy after every meeting.

Rejections don’t always mean your pitch is bad; they often mean you haven’t found the right investor. Stick to your core message and focus on finding investors who align with your vision and values. Your pitch deck should represent your startup’s essence, not what you think investors want to hear.

- Don’t Skip the Competitive Analysis

One of the biggest mistakes founders make is not including a competitive analysis slide in their pitch deck. Investors want to know who your competitors are and how you differentiate yourself. Failing to address this can make it seem like you haven’t done your homework. A solid competitive analysis doesn’t just list your competitors, it shows your unique advantages and highlights where you’re different.

Use this slide to show investors why you have a competitive edge and how you’ll maintain it. Whether it’s through superior technology, a unique value proposition, or a first-mover advantage, clearly articulate why you stand out in the marketplace. Investors will appreciate that you’ve thoroughly considered the competition and have a strategy to stay ahead.

- Lack of Visual Consistency is a Dealbreaker

Your pitch deck is a reflection of your brand, and inconsistency in design can create confusion. Investors expect a professional and cohesive presentation. If your font, color scheme, or layout changes from slide to slide, it signals a lack of attention to detail.

Make sure your design elements are uniform across the entire deck. Consistency in fonts, colors, and layout helps reinforce your message and ensures that investors focus on the content rather than being distracted by design inconsistencies. Use a template if necessary, but ensure your pitch deck looks polished and professional.

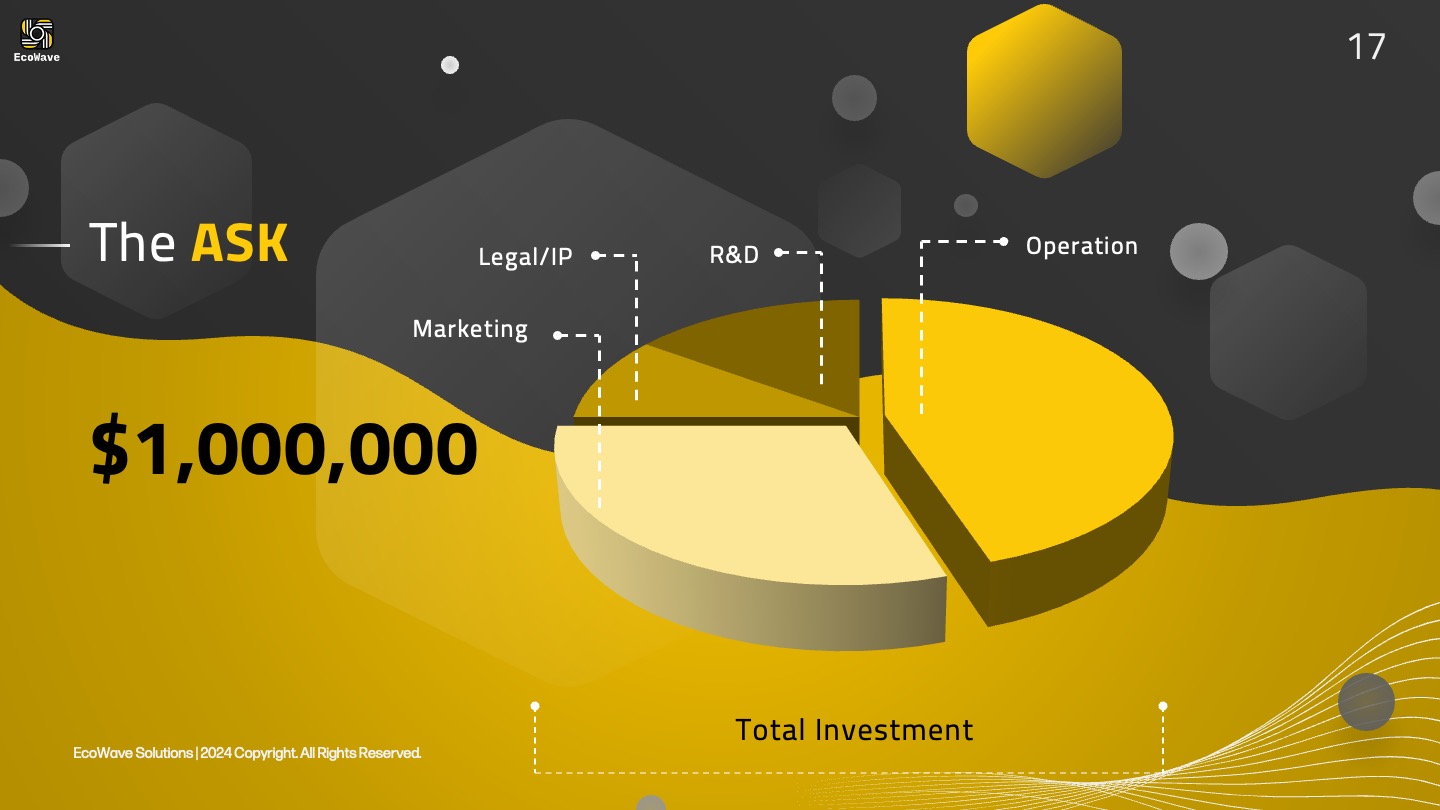

- Stop Ignoring the Financials Slide

Investors want to see a clear financial plan, but many startups gloss over this slide or fail to provide detailed projections. You need to demonstrate that you have a roadmap for revenue generation, costs, and profitability. Be as detailed as possible, showing not just what you expect to make, but how you plan to make it.

If financials aren’t your strong suit, work with a financial expert to create a realistic projection. Investors want to know that you’ve thought about scalability and sustainability. Don’t make the mistake of leaving this critical information out or providing vague numbers. A strong financial slide builds confidence in your business model.

- Failing to Address Scalability

One of the key concerns for investors is scalability. They want to know how your business will grow and whether it has the potential to scale beyond its initial customer base. A common mistake founders make is not showing how they plan to take the business from a small operation to a large, profitable company. Be sure to include a clear plan for scaling, whether it’s through expanding to new markets, adding new product lines, or leveraging technology to increase efficiency. Scalability is crucial to convincing investors of your startup’s long-term viability.

To ensure your pitch deck is investor-ready, avoid the common mistakes we discussed and take advantage of Startup73’s free pitch deck review. This service is designed to provide expert feedback on your existing deck, helping you refine your narrative, visuals, and overall impact. Whether you’re preparing to pitch to VCs or incubators, a professional review can make all the difference. Visit Startup73.com/review-my-pitch-deck today and improve your chances of securing funding.